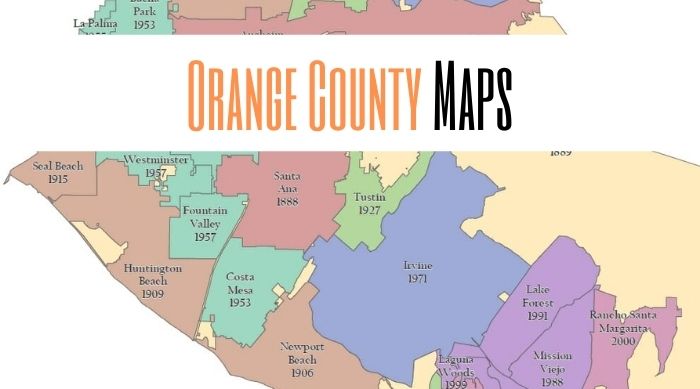

orange county ca sales tax

The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. The December 2020 total local sales tax rate was also 7750.

California Sales Tax Small Business Guide Truic

What Is the Orange County Sales Tax.

. The 2022-23 Property Tax bills are scheduled to be mailed the last week of September 2022. The Orange County sales tax rate is. The 2018 United States Supreme Court decision in South Dakota v.

Currency only paid in person at the Office of the Treasurer-Tax. Tax Rates By City in Orange County California. Average Sales Tax With Local.

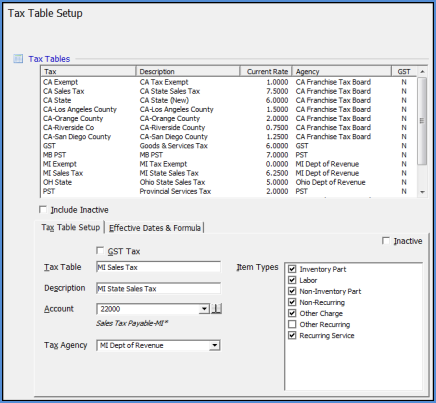

California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35. The sales tax rate in Orange County is 775. This includes the state sales tax of 6 as well as local taxes.

California has a 6 sales tax and Orange County collects an additional 025 so the minimum sales tax rate in Orange County is 625 excluding city or district excise taxes. A county-wide sales tax rate of 025 is applicable to localities in Orange County in addition to the 6 California sales tax. 82 rows The total sales tax rate in any given location can be broken down into state county city and special district rates.

This includes the rates on the state county city and special. The Orange County California sales tax is 775 consisting of 600 California state sales tax and 175 Orange County local sales taxesThe local sales tax consists of a 025 county. The average cumulative rate in the state is 802.

Box 1438 Santa Ana CA 92702-1438. Orange County California Delinquent Tax Sale. This program allows low income.

Those district tax rates range from. For in person tax sales payment must be made in cash US currency only limited to 10000 or a state or federally chartered bank-issued cashiers check made payable to the County of Orange. Currently Orange County California does not sell tax lien certificates.

County of Orange Attn. California has a 6 sales tax and Orange County collects an. The statewide tax rate is 725.

This is the total of state county and city sales tax rates. The first installment will be due November 1 2022 and will be delinquent if paid after December 12. This office is also responsible for the sale of property subject to.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. Orange County sells tax deed properties at the Orange County tax sale. The average cumulative sales tax rate in Orange County California is 823 with a range that spans from 775 to 1025.

The current total local sales tax rate in Orange County CA is 7750. 1788 rows Orange. The minimum combined sales tax.

Internet Property Tax Auction PO. The California sales tax rate is currently. The California state sales tax rate is currently.

Tax Rates By City in Orange County California. Orange County is located in California and comprises 47 cities and towns and 144 zip codes. The minimum combined 2022 sales tax rate for Orange California is.

A county-wide sales tax rate of 025 is applicable to localities in Orange County in addition to the 6 California sales tax. The State of California opened the application period for the California Property Tax Postponement Program PTP.

Orange County Vs Los Angeles Comparison Pros Cons Which Is Better For You

What Happens When A California City Goes Bankrupt Orange County Register

Taxes Fees Make Up 1 18 Per Gallon Of Gas In California Ktla

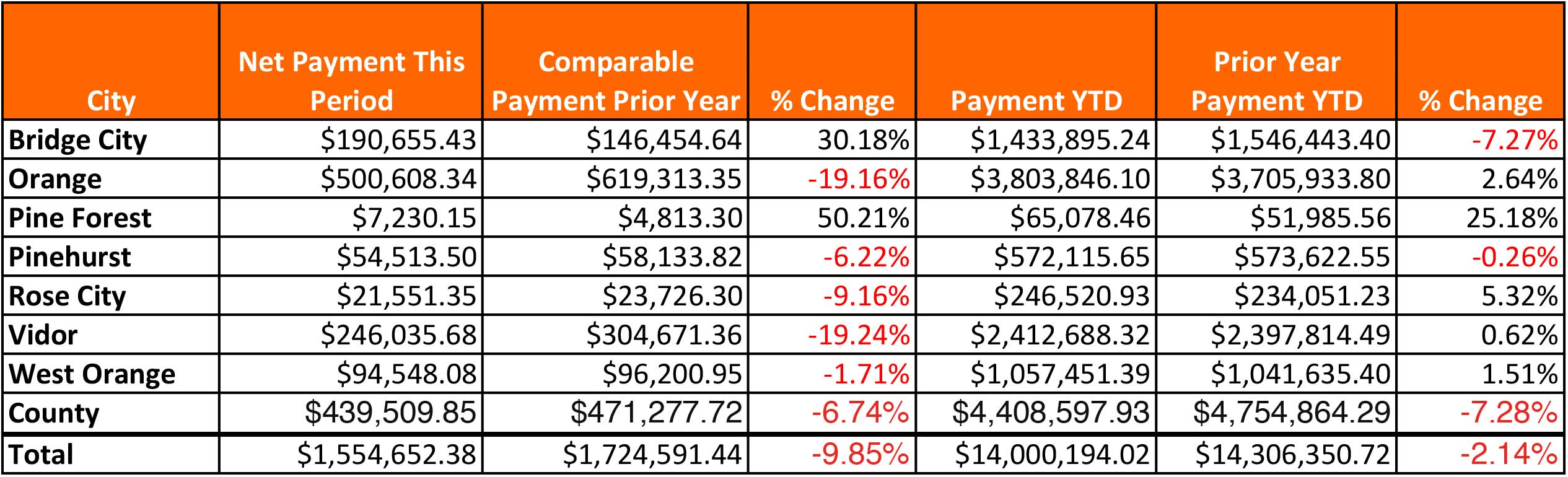

Sales Tax Down For Most Of Orange County Orange Leader Orange Leader

What Should Orange County Do With An Extra 49 Million

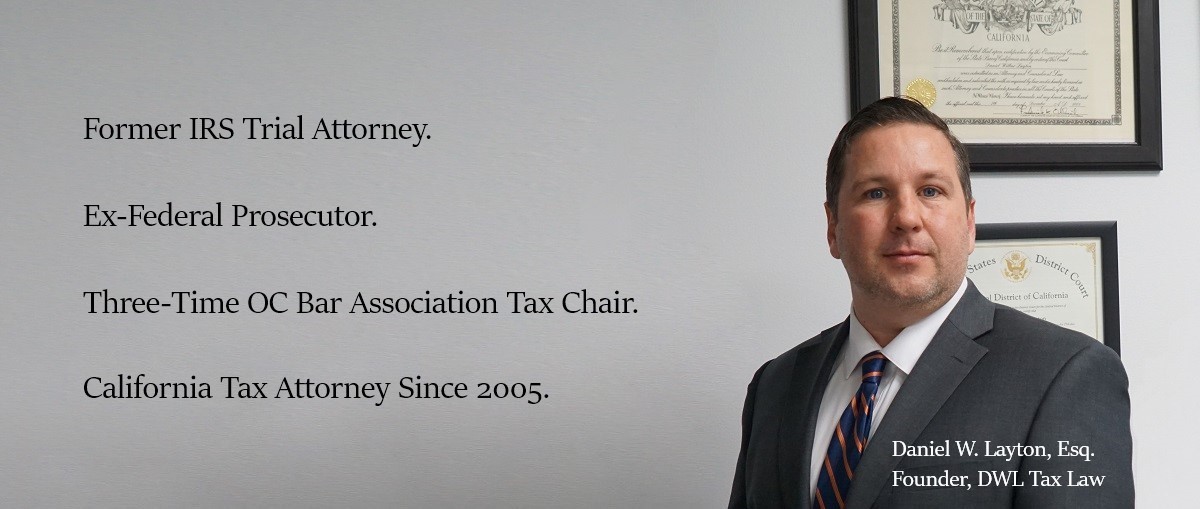

Tax Attorney Newport Beach Ca Orange County Dwl Tax Law Daniel Layton

Orange County Ca Property Tax Calculator Smartasset

Sales Taxes In The United States Wikipedia

Orange County Homes With No Mello Roos Orange County Mello Roos Properties

18 Southern California Cities Will Ask To Raise Sales Tax On November Ballot Orange County Register

California City And County Sales And Use Tax Rates

California Sales Tax Rates By City County 2022

North Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara

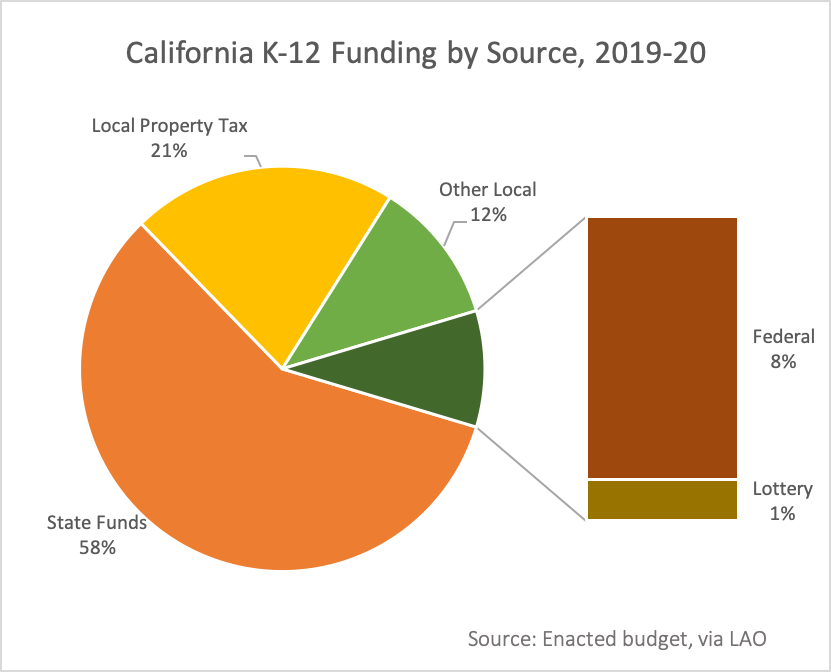

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

Orange County Cdtfa Audit Lawyer Allisonsoares Com

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation